Hi, I'm Laura. My last name is Strom Bob, and I am an enrolled agent based in Stockton, California. I specialize in working with numbers. Today, I would like to share a video tutorial on how you can make approximately $125 per hour tax-free. More specifically, I will be discussing how to accurately and properly value the items you donate to charity and what documentation is required to support the claimed amount. The reason for creating this content is that every year, I come across clients who hand me donation slips from places like Goodwill, Salvation Army, or local thrift stores. These slips often only contain initials, dates, and descriptions such as "one bag" or "two bags." Unfortunately, these slips do not provide any dollar values, leaving me unsure of what to include on their tax returns. When I ask my clients about the appropriate values, they usually have no idea and ask me to use a standard amount. However, there is no standard value to input on the tax return. The actual amount you should claim as a deduction is the fair market value of the donated items. To address this issue, I guide my clients through an educational process. I teach them how to keep accurate records, determine the values of their donations, and provide supporting documentation. By doing so, they can protect themselves in case of an audit and avoid owing any additional money to the Internal Revenue Service (IRS). Now, let's discuss the most important aspect of this process: understanding the law. It is crucial to ensure that we stay within the boundaries of the law when claiming deductions. To learn about the legal requirements, we can turn to the IRS. According to IRS publication 526, the deduction we can take for donated items should reflect their fair market...

Award-winning PDF software

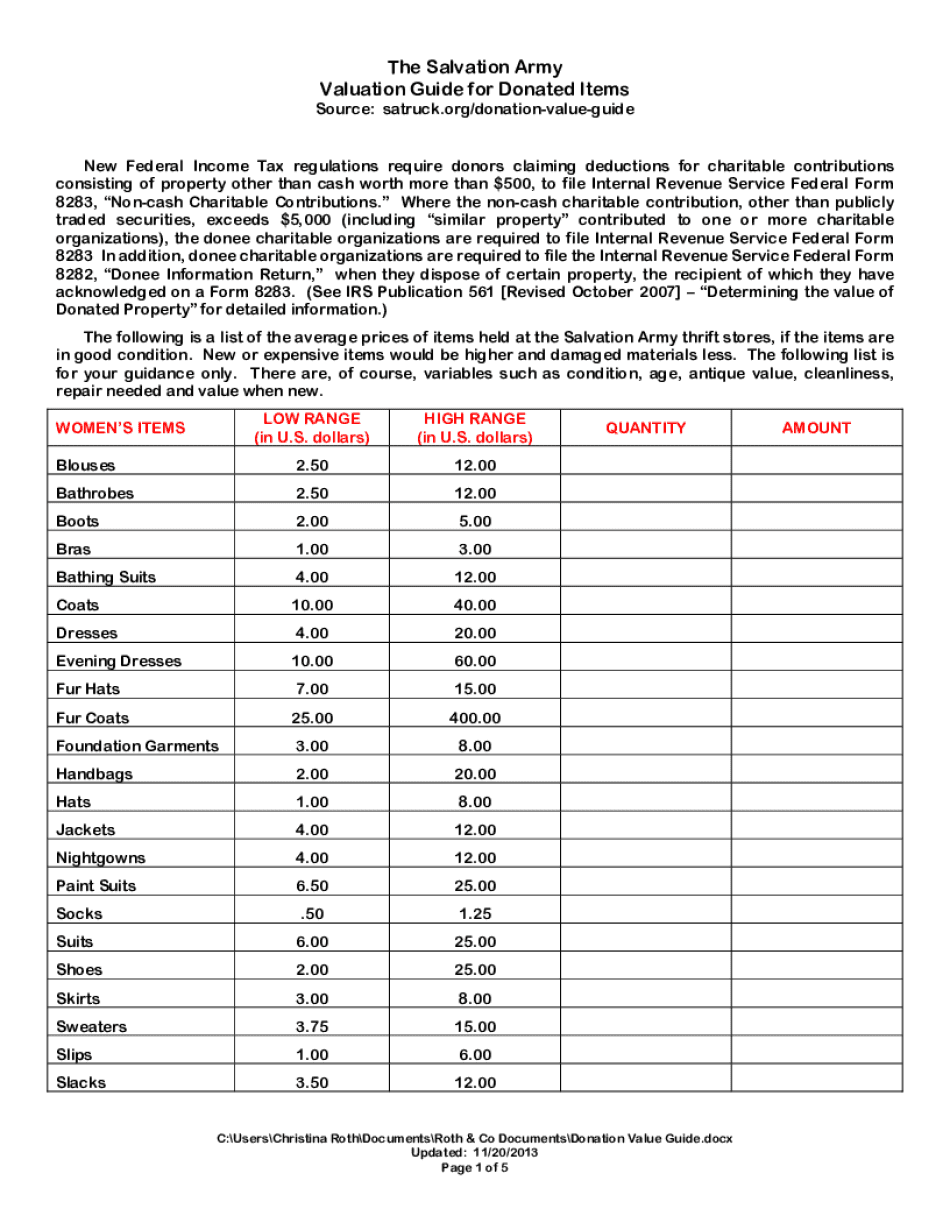

Donation value guide 2013-2025 spreadsheet Form: What You Should Know

We can provide you with online version, downloadable PDF file, and/or printed file of any donation value guide 2025 that you may need.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Salvation Army Valuation Guide, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Salvation Army Valuation Guide online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Salvation Army Valuation Guide by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Salvation Army Valuation Guide from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Donation value guide 2013-2025 spreadsheet