Hello and welcome to part 19 of the income tax education series brought to you by H&R Block, the global leader in filing income tax returns. Today, we will understand whether donations to various charitable institutions are tax-deductible. Donations to charitable institutions are eligible for a reduction from your taxable income. However, there is a condition that these charitable institutions should be registered under Section 8, PG 8, EG GA, or 35 AC of the Income Tax Act, depending on the type of organization you donate to. If you donate to an organization registered under Section 8 TG, you will receive a reduction of only 50% of the donated amount as a deduction from your taxable income. For example, if Thora donates Rs. 10,000 to our relief organization, she will receive a deduction of Rs. 5,000. On the other hand, if Donna donates to Swachh Bharat Coach, which has been recently added to the 80 GG and is registered by the finance minister in the finance bill of 2015, she will receive the entire amount of Rs. 10,000 as a deduction. There are also deductions under Section Appa for people who own and come from business and profession. They get a 100% deduction under Section 35 AC. I hope you found this useful. If you have any further questions on this topic, please feel free to ask us using the hashtag #askedblock.

Award-winning PDF software

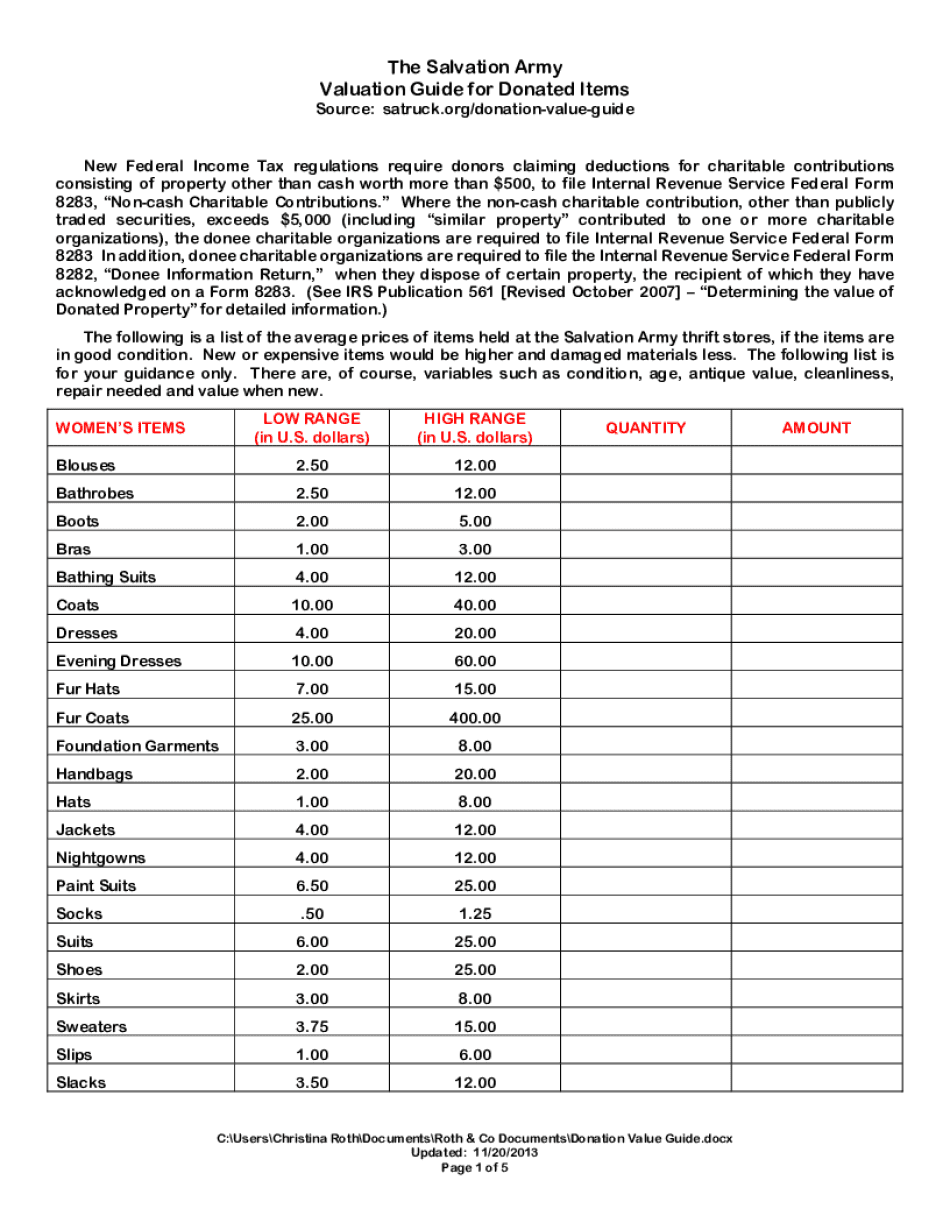

Irs donation value guide 2013-2025 Form: What You Should Know

If the deduction is allowed, it is reported on a Schedule A (Form 1040 or 1040-SR). Tax Deduction For Gifts For Federal Tax Purposes Nov 31, 2025 — Learn how the tax code treats taxable gifts. Charitable contributions are taxed as a gift. The Tax Code and the Charities Act — See Publications 552, 529, and 551, for more information on the tax benefits of nonprofit organizations and the way they are classified. Pub. 524—Tax Effects of Voluntary Contribution Rules. Publication 529, Contributions to Charities — Charitable Contributions — Contributions made to qualified organizations generally are deductible. However, most contributions made to nonprofit organizations are not deductible and, instead, must be reported as interest or dividends to the Internal Revenue Service. Charitable contributions to religious organizations are taxable as ordinary income and are subject to the 2 percent limit on charitable contributions. Charitable Contributions: Contributions to organizations other than qualified organizations. If it was not determined if a gift was made to a qualified organization, the deduction is not allowed and interest or dividends are taxable as ordinary income. In these situations, the charitable contributions must be reported in Box 6 of Form 1040. Charities and Federal Tax Law — Form 1041 or 1042? Dec 9, 2025 — To determine the effective tax rate that should be applied on charitable donations to tax-exempt organizations, the organization may elect either to use Form 990-T or Form 990-EZ. Forms 990-T and 990-EZ will be completed by the organization and filed with the Internal Revenue Service (IRS) along with the tax return as a Form 990, Schedule A (Form 1040 or 1040-A), or Schedule A (Form 1040-EZ). Exercise the Right to Choose Your Own Deductible Charitable Donation — IRS Oct 22, 2025 — The Tax Code permits individuals to make an express written or verbal donation to an individual or organization that is tax-exempt under Section 501(c)(3). In order to exercise this right, the donor must report the donation on line 7 (Form 990), the donation may be itemized if filing separately on Form 1040, 1040A, or 1040EZ. Tax Benefits of Giving to a Charitable Organization — Gift Tax Exempt Organization—Charitable contributions to tax-exempt organizations have a number of special rules and benefits.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Salvation Army Valuation Guide, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Salvation Army Valuation Guide online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Salvation Army Valuation Guide by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Salvation Army Valuation Guide from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs donation value guide 2013-2025