Hi there my name is Sherry Evans I'm the Chief Financial Officer at Goodwill Northern New England and I'm also a CPA first off I'd like to thank you for donating to Goodwill you may not realize it but you may be able to deduct the items you donate on your tax returns save on your tax liability when you donate at Goodwill you scan the QR code and it will immediately email you a receipt or you may have a paper receipt in which case you just fill out the date in your name and there's a place for the value of the items that you've donated to find the value you can just look on the back of the form or you can go to our website goodwillnne.org now when you file your tax return you would want to itemize deductions instead of taking the standard deduction itemizing deductions is usually most advantageous for folks who own a home and can deduct mortgage interest taxes or people with high out-of-pocket medical costs or those who make large amounts of donations to charities so when you file your 1040 form in order to itemize you'd want to select the itemized deduction instead of the standard deduction and then on schedule a you would list the expenses you had related to your home mortgage interest taxes you can also deduct your medical expenses and both cash and non-cash items such as the items you donated on this form if you donate over 500 worth of items to Goodwill you would then need to complete form 8283 which just asks for a little more information about those items if you need help filing your tax return you can go to the IRS website and they can provide a list of free...

PDF editing your way

Complete or edit your salvation army donation value guide anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export valuation guide donated items directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your donated items valuation guide as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your salvation army valuation guide by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Salvation Army Valuation Guide

About Form Salvation Army Valuation Guide

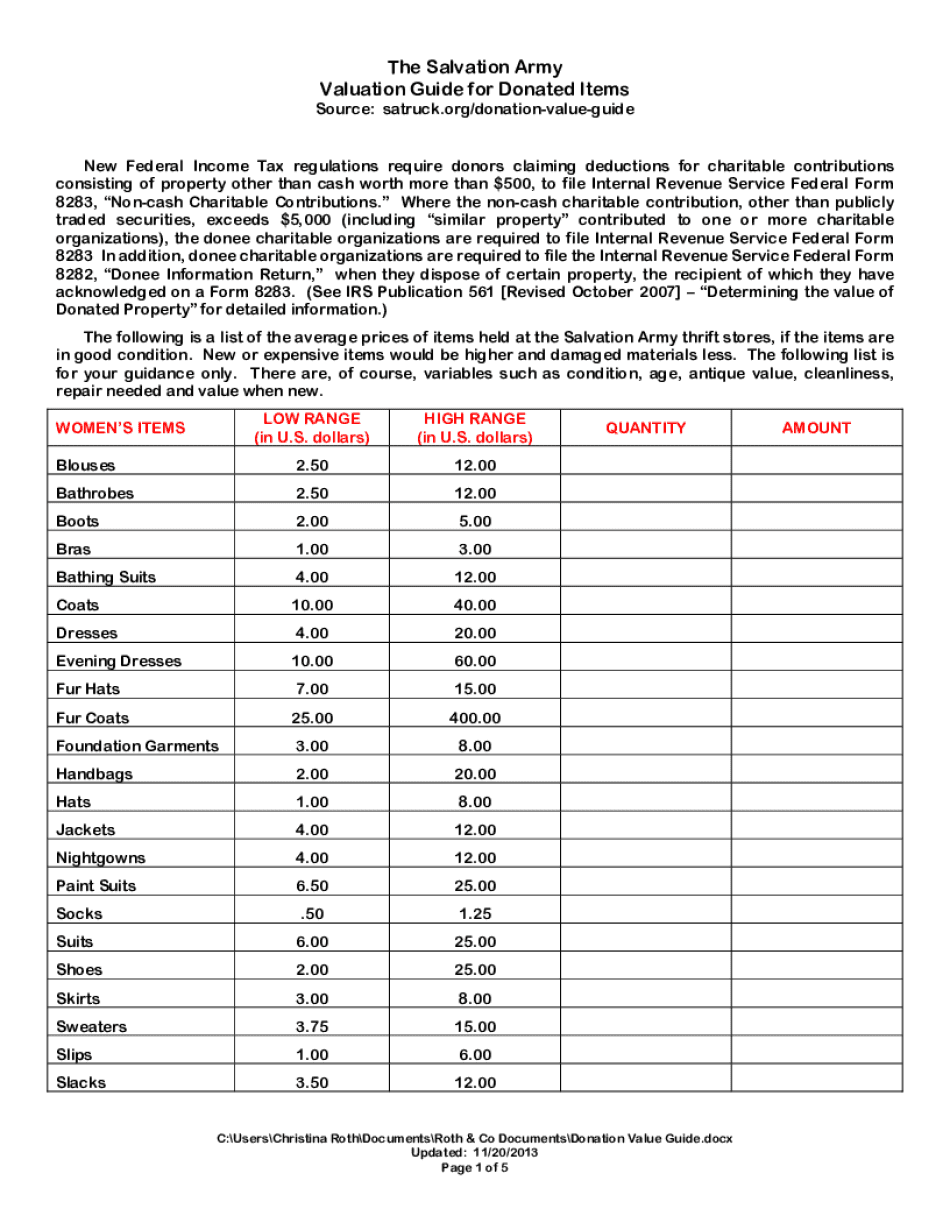

The Form Salvation Army Valuation Guide is a comprehensive resource provided by The Salvation Army, a renowned charitable organization. This guide is designed to assist individuals in determining the fair market value of their non-cash donations made to the organization. The Salvation Army accepts various types of non-cash donations, including clothing, household items, furniture, electronics, and vehicles. When individuals donate these items, they may be eligible for a tax deduction based on their fair market value. The Salvation Army Valuation Guide provides estimated values for different types of items, helping donors assess the worth of their donations for tax purposes. It includes a wide range of categories and provides suggested values, which are typically based on the condition, age, and quality of the items being donated. This valuation guide is primarily intended for individuals who donate non-cash items to The Salvation Army and wish to claim a tax deduction. It offers a convenient and reliable reference for donors to determine the value of their contributions accurately. By utilizing this guide, donors can ensure they receive the appropriate tax benefits while supporting the charitable work of The Salvation Army.

What Is Salvation Army Donation Value Guide?

If you have donated something to a charity, you have to determine its value. It affects how much in taxes you will save. Considering, that flea market prices are too low, it’s not advisable to ethe value of donated things basing on what they might sell on a garage sale.

For your convenience, use the Salvation Army Valuation Guide. Salvation Army offers a printed form, that lists values of 138 items, mostly clothing as either Low or High. Thus, you may ethe average price for the thing listed in the document.

Take into consideration the fact, that all thing must be in good condition. New or expensive items would be estimated higher and damaged items will get a lower price. Note, the list is only for your guidance. There is a range of criterias for calculating the price such as:

- condition,

- age,

- antique value,

- cleanliness,

- repair needed,

- and value when new.

How to get the Salvation Army Valuation Guide Form?

Find a PDF template on the website. Easily edit and customize it to fit your needs. You may erase any content from a document if needed and highlight the important information.

Notice: If you use the Salvation Army Valuation Guide, you would probably ea fair market value and deduct that as a charitable contribution on the Schedule A Itemized Deduction form. However, if you used a donated thing for your business, you must subtract from this fair market value the amount of any deduction you claimed on it for your business.

Online methods make it easier to prepare your document management and raise the efficiency of the workflow. Follow the quick help to carry out Form Salvation Army Valuation Guide, prevent mistakes and furnish it within a well timed manner:

How to accomplish a Form Salvation Army Valuation Guide on the internet:

- On the website using the sort, click on Commence Now and pass to your editor.

- Use the clues to complete the appropriate fields.

- Include your personal details and make contact with info.

- Make guaranteed that you enter correct information and facts and numbers in acceptable fields.

- Carefully check the written content within the kind as well as grammar and spelling.

- Refer to aid segment should you have any thoughts or deal with our Aid staff.

- Put an electronic signature with your Form Salvation Army Valuation Guide using the aid of Indication Device.

- Once the form is accomplished, push Undertaken.

- Distribute the all set sort by using e-mail or fax, print it out or save with your machine.

PDF editor lets you to definitely make improvements in your Form Salvation Army Valuation Guide from any web connected system, customize it as outlined by your needs, indicator it electronically and distribute in various tactics.

What people say about us

The increasing need for electronic forms

Video instructions and help with filling out and completing Form Salvation Army Valuation Guide